Streamlining Investment and Holding companies with NetSuite for Investment

In today’s fast-paced, globalized business environment, managing multiple subsidiaries and legal entities can be incredibly complex. Companies face the challenge of maintaining visibility and control across various regions, while also ensuring compliance with diverse local and international regulations. NetSuite for investment provides a powerful solution to these challenges, offering businesses a unified platform to manage their operations both domestically and internationally. With real-time financial and operational insights, companies can streamline processes across all levels—from local branches to headquarters—and ensure seamless integration and compliance across the entire organization. This comprehensive solution adapts to regional differences in currency, taxation, and legal requirements, providing the clarity and control businesses need to thrive in a global market.

Key Benefits of NetSuite for Investment

NetSuite for investment offers a range of key benefits that enable businesses to effectively manage their global operations while maintaining clear visibility and control at every level of the organization. These benefits include:

1. Manage Multiple Subsidiaries, Business Units, and Legal Entities

NetSuite for investment provides corporate and divisional leaders with a comprehensive view of business performance across all subsidiaries and entities. Leaders can easily access both high-level summaries and detailed data, ensuring they have the insights needed to make informed decisions and maintain operational efficiency.

2. Complete ERP System in the Cloud

By operating entirely in the cloud, NetSuite for investment allows businesses to run both corporate and subsidiary operations without the burden of maintaining costly on-premises IT infrastructure. This reduces overhead, improves scalability, and ensures that all locations have access to the same up-to-date system, no matter where they are.

3. Gain Real-Time Visibility

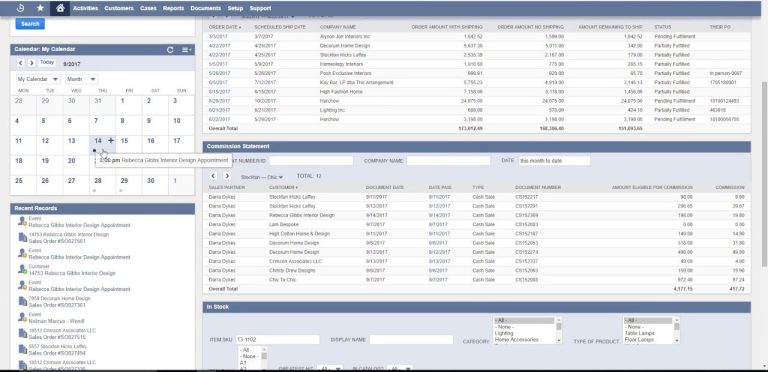

Netsuite for investment accelerates financial processes by providing multi-currency consolidation and real-time roll-ups across essential functions such as accounts receivable, accounts payable, inventory, and order fulfillment. This enables businesses to monitor performance instantly and make quicker, data-driven decisions, leading to improved efficiency and agility in global operations.

NetSuite for Investment Features

1. Global Business Management

NetSuite for Investment is designed with powerful financial reporting capabilities that give organizations real-time insights into their global operations. Its multi-language user interface helps overcome communication barriers and offers a flexible structure that simplifies the management of an organization’s entire entity hierarchy. NetSuite for Investment delivers an up-to-date global view of the business, with the ability to drill down into subsidiary-specific details, providing a clear understanding of activities across different regions.

2. Intercompany Accounting and Consolidation

NetSuite’s unified data model makes intercompany reconciliation and netting more efficient. It allows a sales order created by one subsidiary to be directly linked to a purchase order from another. When these orders are invoiced, the system recognizes the transaction and automatically creates the required elimination journal entries. With intercompany netting, accounting managers can streamline the process of balancing intercompany accounts and create settlements for specific transactions with ease.

NetSuite for Investment also speeds up the month-end closing process, making it simpler to generate timely and accurate consolidated financial reports. Its flexible general ledger supports a standardized chart of accounts, while allowing for customized account codes for individual subsidiaries. Transactions recorded under a specific set of codes at the subsidiary level are automatically mapped to the appropriate accounts at the parent level.

3. Comprehensive Multi-Currency Management

NetSuite’s multi-currency management feature supports over 190 currencies and exchange rates, enabling smooth transactions with customers and vendors worldwide. It offers a wide range of payment options, real-time currency conversion, and financial consolidation. With NetSuite for Investment, businesses can handle diverse international tax structures, perform currency restatements, and consolidate financial reporting across various business units.

4. Audit and Compliance Reporting

NetSuite for Investment is built to meet global and country-specific compliance standards. It features a continuous audit trail, built-in analytics, access logs, and workflows, as well as the ability to access underlying transaction details, ensuring that comprehensive documentation is always available. User access is managed through roles and permissions, providing secure control over data. The SuiteCloud platform enables extensive customization and development while maintaining a secure, scalable, and global framework, ensuring that businesses always operate on the latest software version.

5. Configurable Tax Engine

NetSuite for Investment supports indirect tax regulations and reporting across more than 100 countries. The SuiteTax engine provides a flexible and scalable solution for tax determination, calculation, and reporting, tailored to meet any tax rule worldwide. It automatically calculates taxes in real time on sales, purchases, and cross-border transactions, manages Intrastat reporting within EU countries, and enables electronic report submission, often eliminating the need for a separate tax engine for many businesses.

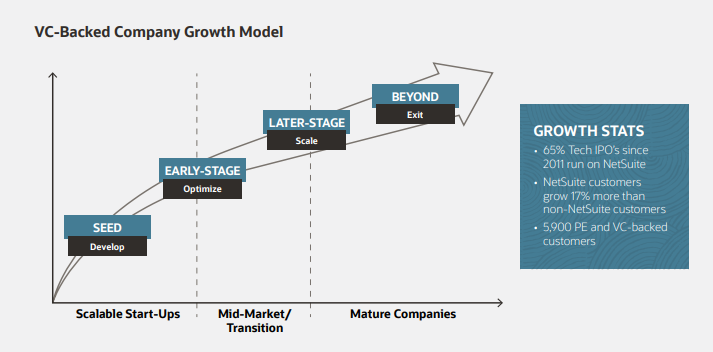

Navigating the Venture Capital Boom with NetSuite for Venture Capital-Backed Companies

The venture capital landscape has evolved rapidly in recent years, marked by an unprecedented influx of available capital. Investment levels have surged, with median deal sizes across all funding stages reaching new heights. Start-ups are raising capital amounts previously reserved for later stages much earlier, and as more investors enter the scene, large funding rounds that were once rare have become routine. In this competitive market, start-ups need to think bigger, act boldly, and accelerate their pace—requiring a solution that can be quickly implemented and deliver substantial value right away.

NetSuite for investment and Venture Capital-Backed Companies offers solutions tailored to meet the needs of start-ups and help them deliver on their growth ambitions. With a focus on driving top-line growth, NetSuite supports businesses through every phase of their lifecycle:

Seed Stage

Start-ups in the seed funding phase often run lean, focusing every dollar on product development, market entry, and building their leadership team. While back-office technology might seem like a secondary concern, establishing a strong financial foundation is crucial. NetSuite provides a fast, proven, and tailored solution, offering industry-specific features that can be implemented within 45 days, helping early-stage companies get up and running swiftly without disrupting daily operations.

Early Stage (Series A-B)

As companies move into early-stage funding, their focus shifts to refining their business model and generating revenue. This stage demands a deep understanding of the customer base and the ability to track incoming revenue effectively. NetSuite offers comprehensive financial management, including customizable general ledger capabilities, automation of billing, and end-to-end visibility of receivables and payables. Additionally, the platform enhances customer relationship management, streamlines sales processes, and provides tailored dashboards for effective decision-making.

Later Stage (Series C and Beyond)

Companies in later stages with established products are often focused on expanding their reach, whether through new markets, mergers, or acquisitions. NetSuite’s scalable platform is designed to handle increased operational complexity, managing multiple subsidiaries, handling new currencies, and meeting compliance requirements. It supports consistent processes across regions, ensuring real-time global insights and streamlined operations.

NetSuite’s comprehensive capabilities make it the ideal partner for venture-backed businesses looking to scale quickly while maintaining operational excellence. It supports growth across each phase of development, offering a unified suite of tools that businesses can rely on for agility, efficiency, and long-term success.

How NetSuite for Investment is A Comprehensive Platform for Alternative Asset Investment Firms?

NetSuite offers a powerful solution for private equity investors, venture capital firms, and family offices, enabling them to manage the entire investment lifecycle on a single, integrated platform. As regulatory scrutiny, especially from the U.S. Securities and Exchange Commission (SEC), intensifies, investment firms are increasingly required to maintain transparency and accurate reporting. This makes a robust ERP system like NetSuite critical for their operations.

Investment Optimization with NetSuite

It helps firms track the full investment lifecycle—from sourcing and acquisition to liquidation—while providing a centralized view of profitability. This capability is especially important in a sector managing over $17 trillion in gross assets. The typical reliance on basic accounting software like QuickBooks and Excel can make it difficult for firms to respond to audit requests and produce accurate reports quickly.

Addressing the Challenges of Regulatory Compliance

The alternative asset industry has faced challenges due to outdated systems and reliance on manual processes. With NetSuite’s cloud-based platform, firms can centralize data, streamline back-office operations, and automate processes like capital calls and investor allocations, significantly reducing reliance on disconnected systems. This leads to higher levels of transparency, allowing firms to respond to audits more efficiently and make data-driven decisions with confidence.

Conclusion

Schedule a free consultation with a premier NetSuite Implementation Partner today.